10 Ways to Save £10 a Day

Saving always seems hard but sometimes its just about making a few adjustments to your daily habits that will save you a ton in the long run. Where you save depends on where you spend the most, so here are a few ideas that will have you saving and boost your ability to budget. Pick which of these tricks work for you and reap the rewards at the end of the month.

1. Delay Impulse Shopping

It’s hard to resist when you see something that you just have to have. But this is a major must! Give yourself 24-72 hrs to decide if you really need it. Along with this goes running to the shop to get those essentials to ‘tide you over’ for a couple of days…where you inevitably end up returning with far more ‘essentials’ than you originally set out for. A routine shopping trip with a list is the best way to stop over spending. It’s always the errands that have you splashing out on extras.

2. Low-Cost Substitutes

Activities and hobbies are a must to keep life interesting but there are ways to stop it from being a money-guzzling cash drain. Try to find economical ways to still do the things you enjoy. If you’re a golfer for example, substitute one tee-time a week for a trip to the community driving range. This is not about giving up on the things you like. It’s just a way to save in the long run.

3. Downsize

Evaluate the lifestyle changes that you can make and make the cuts where you can. It might be your gadgets, car, clothes. It might be hard at first but soon you’ll find that the money you’ve saved makes you feel so much better than the things you were identifying yourself by.

4. Drive Less

Carpooling and public transport might not be the something you enjoy but just using them once a week can save you a bundle in the long run. Why not ask if you can telecommute 1 day a week? Consolidate your errand trips and save!

5. Love the Lunchbox

Try not to leave the office on your lunch break and take a packed lunch every once in a while. Factor snacks into your weekly shop and take them in with you, rather than constantly buying them while you’re out. Plus, there is always the refillable water bottle trick – you can pick up bottles with inbuilt filters or infusers fairly cheaply. You’d be surprised how much small changes like these will save you.

6. Unsubscribe

A massive chunk of money is taken out of your account by all the monthly/annual membership services you sign up to. They are dangerous because whilst often seemingly cost effective, they are easy to forget about and feel like invisible money! Gradually they start to add up, so if you’re not using them it’s time to be ruthless and cut down. Consider whether you’re actually getting your money’s worth. With things like gym, if you’re the self-motivated type there are hundreds of fitness activities you can do at home or free clubs you can join for example – expensive monthly gym membership eliminated!

7. Supermarket Sweep

Feeding the family can be expensive and also stressful as you bewilderingly watch the supermarket checkout total creep up and up and up with every beep of the scanner. However, although it can be a bit of a mixed bag, the reduced section is definitely worth getting your elbows out for especially if you can work out the pattern for when it gets stocked and be the one to get in there first! You can often find decent reductions on what is actually perfectly edible produce, from vegetables through to meat. Precaution obviously does need to be exercised with perishable items and you don’t have much time to think about what you’re going to do with it but meat or bread for toast for example can go straight in the freezer, or you could cook it up straight away and then enjoy the leftovers throughout the week.

8. Get your Tunes for Free

We all love our MP3 players. They’re our soundtracks to our lives but if you don’t mind a variety of music through the day then why not opt for free or subscription sites like Spotify or Pandora rather than spending the dough on individual songs.

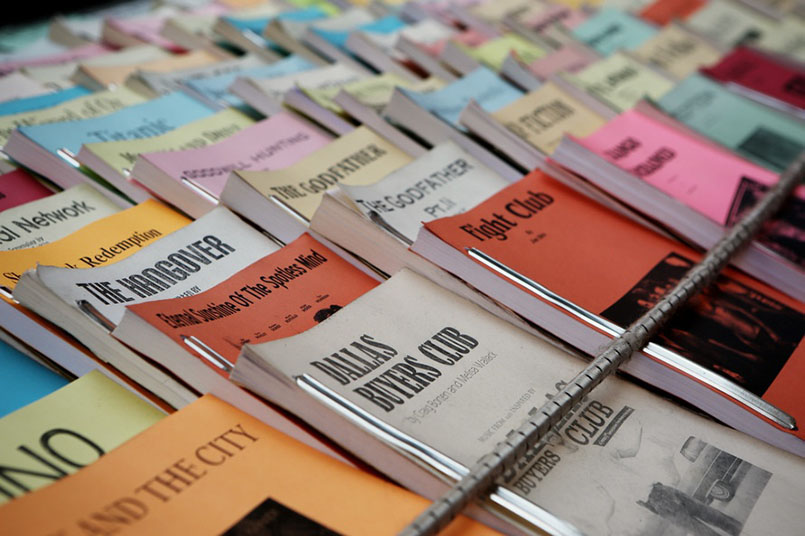

9. Swap don’t Buy

It’s time to return to Viking times and get back to barter and trade rather than cash-in-hand purchases. Readitswapit.co.uk is a great example of a way to do just that. The idea is that once you’re done with a book you can swap it with someone else for a book of theirs rather than paying for a new one. At readitswapit, they have tons of books to choose from.

10. Transfer that Debt

Balance transfer credit cards and transfer the debt from your current card that charges a high-interest rate to one with 0% interest. Shop around and find one that works for you as a way to save the strain on your budget